NEAR Token Supply and Distribution

Last updated: 20201016 (see change log section at the end)

NEAR exists to enable community-driven innovation to benefit people around the world. The platform and its surrounding ecosystem rely on the efforts of a broad community of participants, builders, validators, delegators and more to succeed. This post will help you understand how the core facilitating component of the protocol, the NEAR token, is distributed to support the launch of this ecosystem.

Using this Post

The intent of this post is to give you a clear picture of the initial distribution of tokens for the NEAR protocol. Wherever possible, we’ll use charts and tables to explain, but we’ll also contextualize them with the thinking behind it all. Data is beautiful 🙂

Each section should be self-explanatory but there are some methodological notes at the end. The charts will generally present the most conservative case when there is a choice. The accuracy or certainty of numbers may vary by category, as noted below.

Changes to the post will be noted in the Changelog section at the end so it is clear how up-to-date it is and what has changed between versions.

About NEAR

For those who aren’t familiar, NEAR is a decentralized application platform that secures high value assets like money and identity while providing the performance necessary to make them useful for everyday people. It is built atop a brand new public, proof-of-stake blockchain which uses a novel consensus mechanism called Doomslug and a new sharding approach called Nightshade which splits the network into multiple pieces so that the computation is done in parallel and there is no theoretical limit on capacity.

NEAR’s contract-based account model provides the flexibility that other chains only get from second layer components, allowing NEAR to consistently provide better native usability for developers, validators and end-users.

NEAR launched its genesis (Phase 0) on April 22, 2020, became community-operated (Phase I) on September 24, 2020, and passed the decentralized vote to enable transfers on October 13, 2020 (Phase II). It is now fully live.

Key Facts

The following will help you better contextualize the sections below:

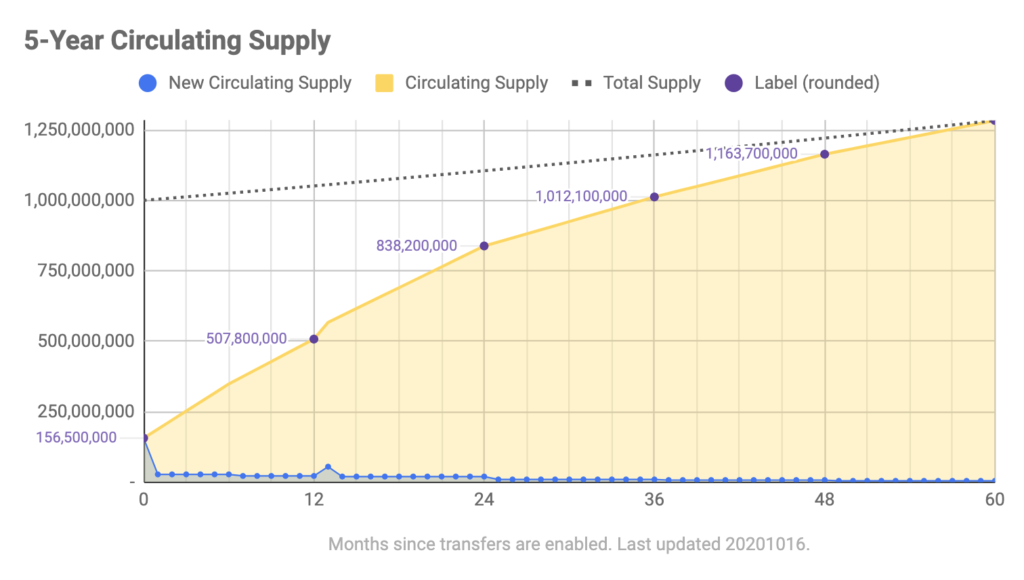

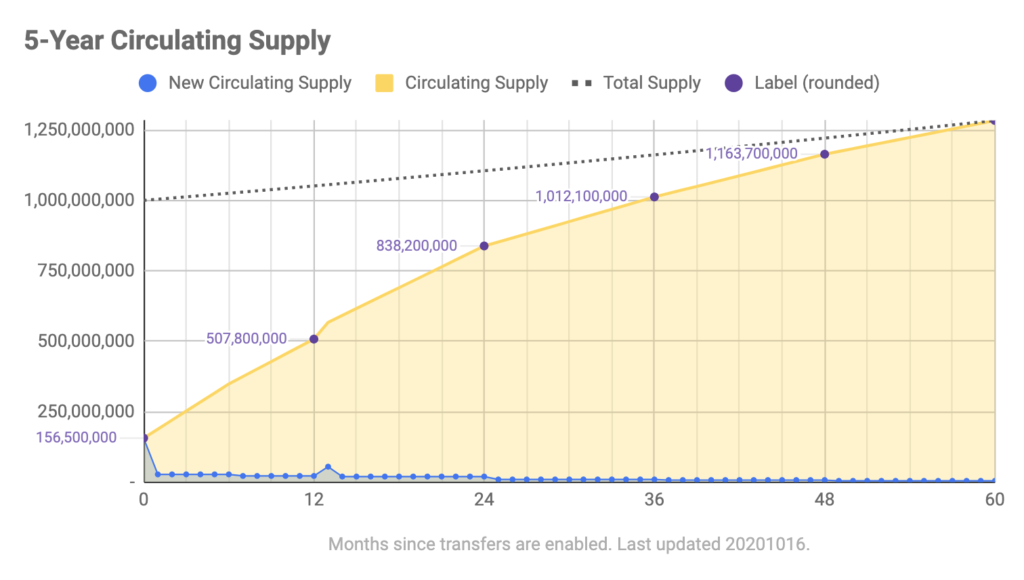

- Genesis Tokens: There were 1 billion NEAR tokens created at genesis. They are being allocated to individuals and organizations on an ongoing basis during the rollout of MainNet. Inflation, transfers and unlocking did not begin until the final phase of MainNet (“Phase II”), which started on October 13, 2020. All charts in this post begin on the date when transfers were enabled (which will be determined by the community). See below for circulating supply.

- Contract-Based Accounts: NEAR uses a smart-contract-based account model, meaning that each account is actually a smart contract as well. Account names are thus human-readable (eg `foobar.near`) and contain any number of uniquely-permissioned keys. Thus it’s possible to have staking keys separate from transfer keys.

- Transfer Restriction: Until the network officially reached the Community-Governed MainNet phase (aka “Phase II”), the accounts of token recipients were prevented from directly transferring tokens (but they could still be used to pay for gas or storage, staked, delegated, used to deploy apps, etc).

- Lockups and Unlocking: The vast majority of tokens are subject to linearly releasing lockups. These lockups are implemented as contract-based locks atop various accounts. Lockups are generally implemented in a linear, per-block fashion instead of in monthly chunks, though some might be implemented that way as well. Lockups begin unlocking when the transition to the final Community-Governed MainNet phase occurs (aka “Phase II”). We use the term “linear lockup” or “linear release” where some other projects use the term “vesting”, so you may know it by that name.

- Staking and Delegating while Locked: NEAR is a Proof of Stake network where validating nodes put at stake either their own tokens or tokens which have been “delegated” to them by other holders. The number of validating nodes depends on the number of shards in the network but will start at 100. Because of NEAR’s account model, tokens can be staked or delegated even while they are locked.

- Foundation Delegation: The Foundation is only actively running nodes during the initial phase of the network rollout. Thereafter, as noted in this post, it will shut down its nodes and be limited to delegation. It will only delegate tokens in its endowment.

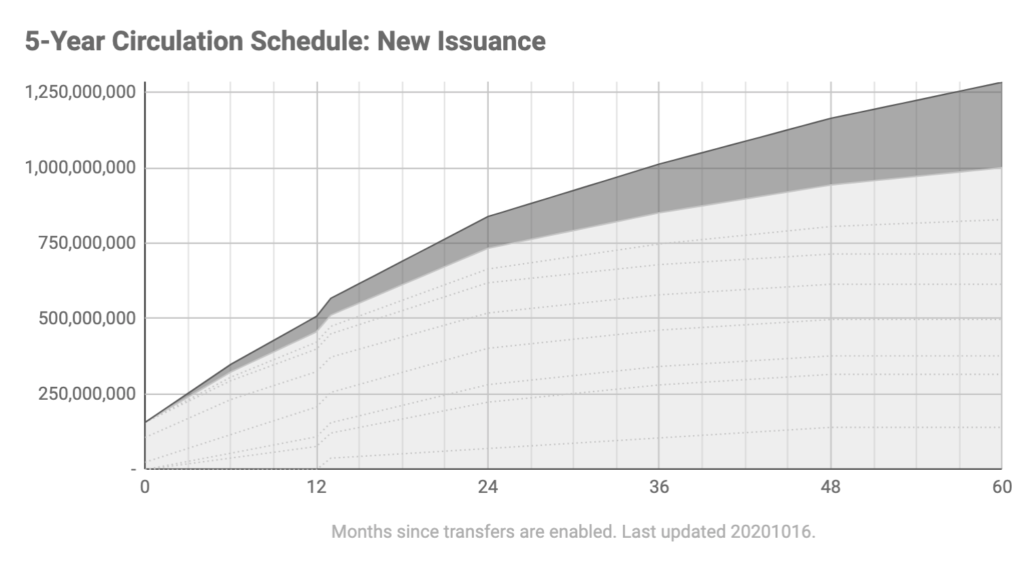

- New Issuance and Economics: As per the Economics Blog Post and Economics Paper 5% of additional supply is issued each year to support the network as epoch rewards, of which 90% goes to validators (4.5% total) and 10% to the protocol treasury (0.5% total). 30% of transaction fees are rebated to the contracts touched by the transaction and 70% are burned. Because of this burning, at high levels of transaction throughput the network could become deflationary. In this post, we assume the pessimistic case of 0 fees. New supply creation does not begin until the transition to the final Community-Governed MainNet phase occurs.

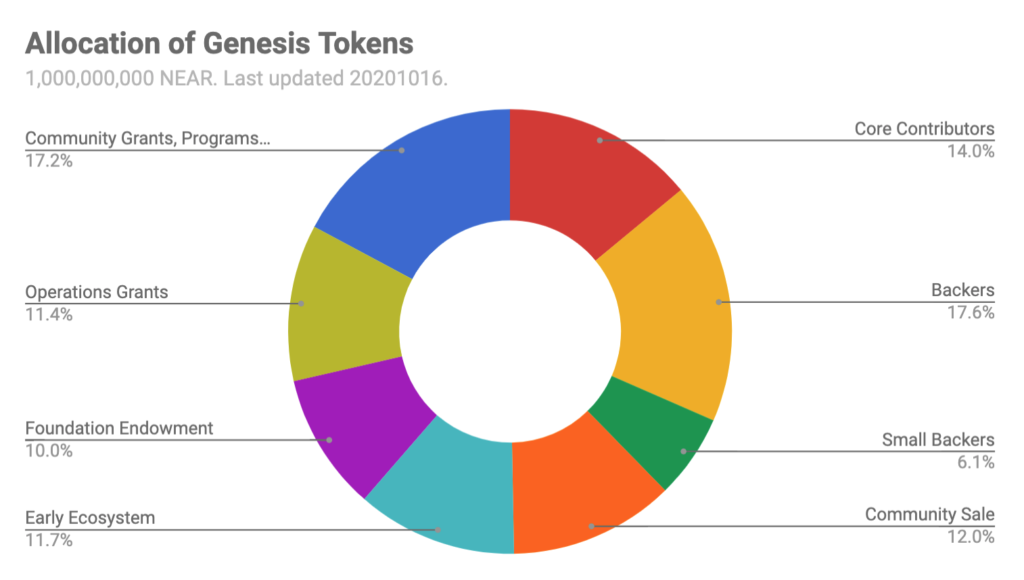

Overall Allocation and Supply Schedule

There were 1,000,000,000 NEAR tokens created at Genesis on April 22, 2020. This will be allocated in the following way, where each category is described in greater detail in the following sections:

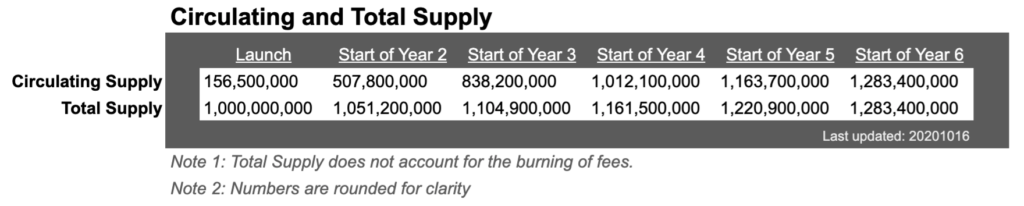

“Circulating Supply” is every token that isn’t subject to a lockup at a particular time. The vast majority of the initial supply of NEAR tokens is subject to long-term lockups. So the initial circulating supply is made up of provisions for a community sale, a future distribution activity, a small handful of community contracts and the Foundation’s liquid endowment. All supply that existed at genesis is unlocked by month 60.

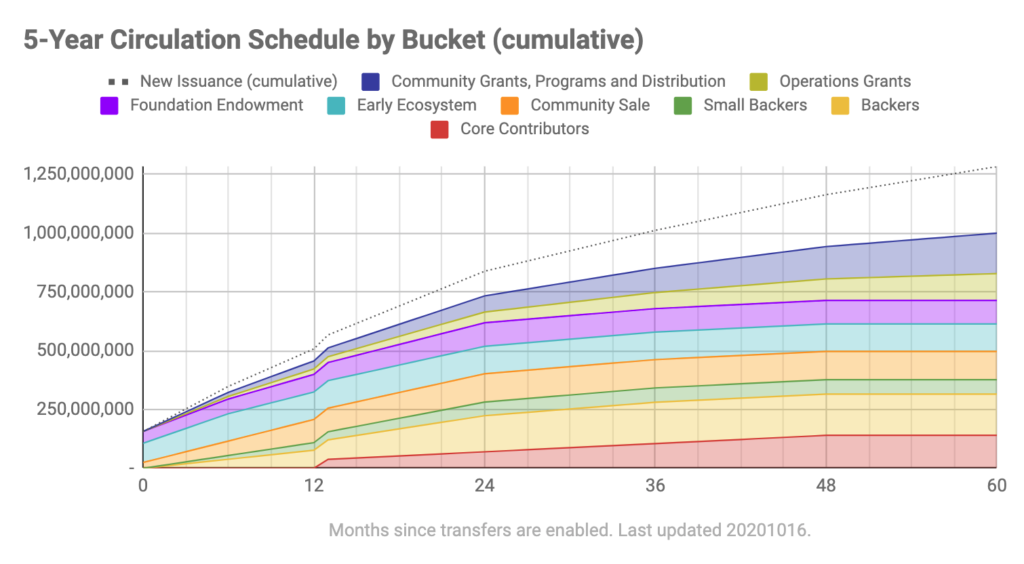

The chart below shows the increase in circulating supply as tokens unlock and new tokens are minted. The dotted line shows the total supply as it increases due to new issuance (but ignores any burning that would be due to fees). This and all charts begin on the date that transfer restrictions are lifted (“Phase II”):

The table below shows the circulating supply for commonly used date milestones:

The following chart provides more detail on the components of the circulating supply as it grows over time. Each category is explained in further detail in the following sections. Note again that all genesis tokens are unlocked by the end of month 60.

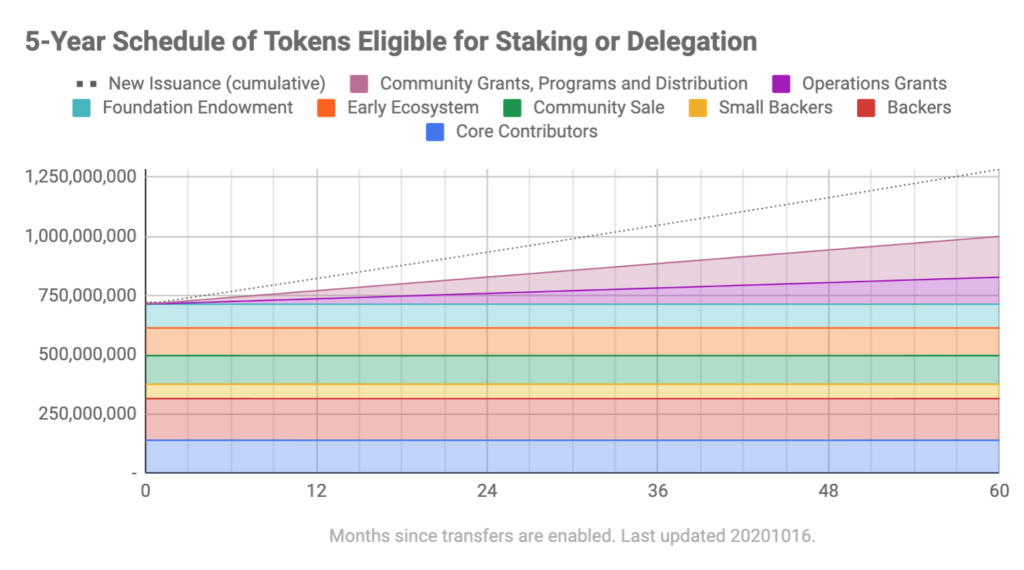

Because the network is secured through running Proof-of-Stake validating nodes, it is relevant to discuss how much stake can participate in validation (directly) or delegation to validators (indirectly). Distribution-oriented categories (like “Community Distribution”) will only participate in delegation when the tokens are received by their intended recipient, so these numbers represent the maximum amount of stake that would theoretically participate in validation. In reality, it will certainly be less.

Category Detail

Each category is explained in more detail below.

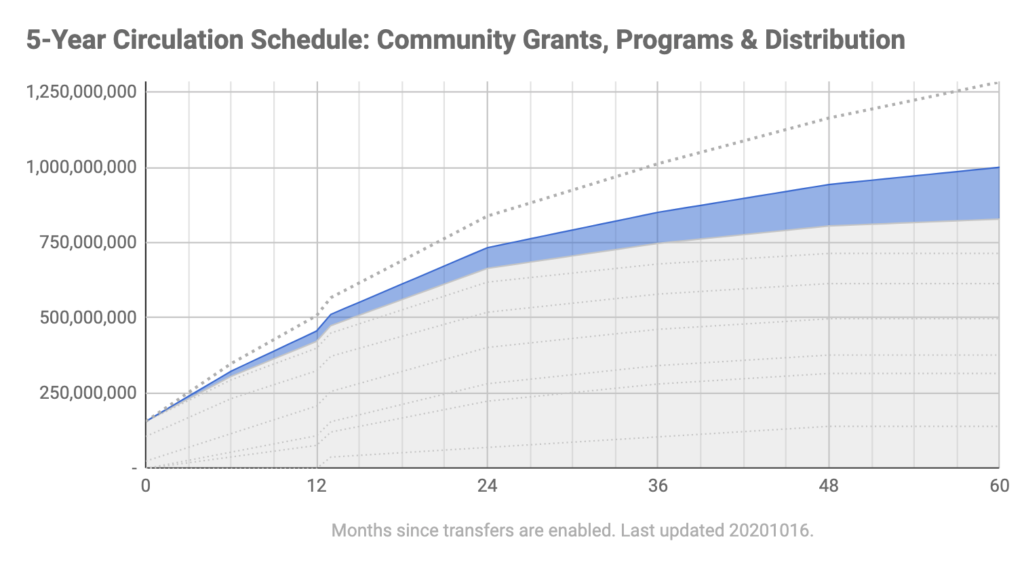

Community Grants and Programs

A large portion of tokens is devoted to grants and programs which fund community efforts, community projects and community-built technical components. This spans everything from education to events to direct deployment into venture-style funding for projects. A small provision exists for tokens that can be given away or sold in the future. Because these efforts are decidedly long-term in nature, the tokens are released over 60 months.

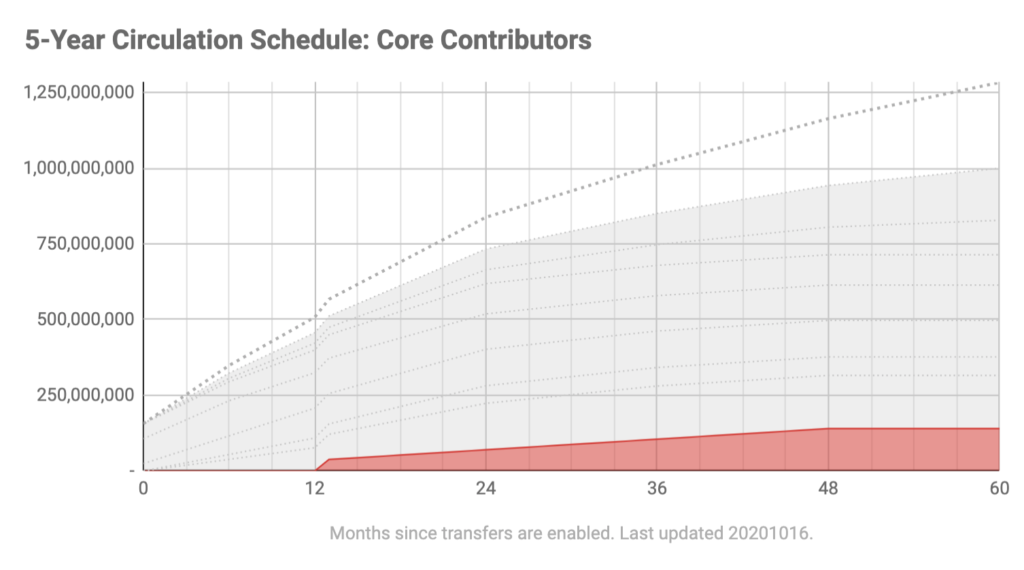

Core Team

In 2018 when NEAR built its early momentum, blockchain projects were already imploding with alarming frequency, in part because they set the wrong incentives for their teammates. Some didn’t launch at all and others were abandoned shortly after they did.

NEAR is being built by one of the strongest teams in the world, which is spread across multiple continents and many backgrounds. Core team members have been important in the early success of the protocol and they are incentivized to remain active with its development for a long time afterward — every single member has the identical 4-year lockup with a 12-month cliff after launch, which you can see in the chart.

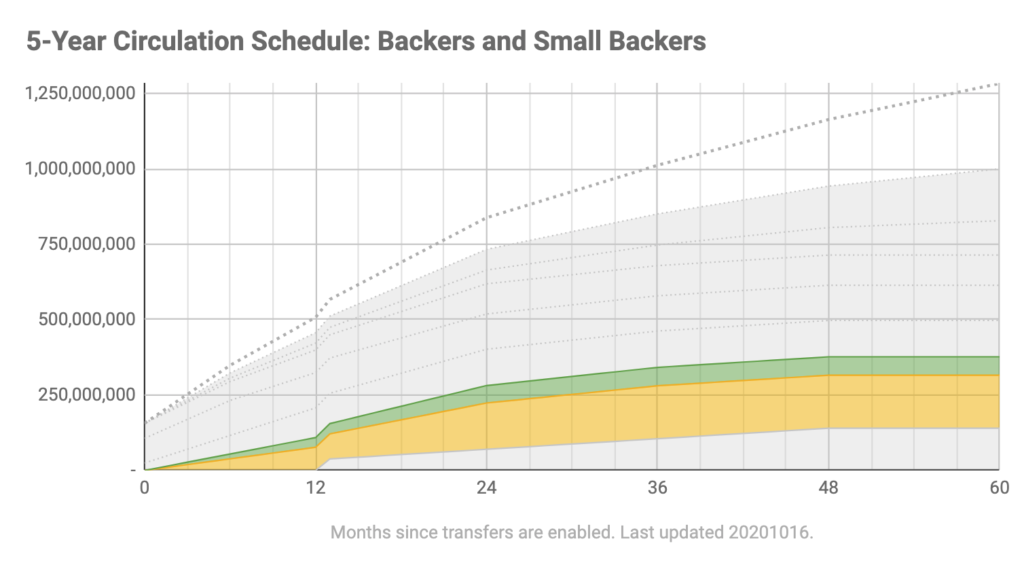

Prior Backers

Most project funding occurred during a severe crypto bear market and during a period where the crowdsales of the past were no longer feasible. The team’s philosophy when sourcing early backers to support the project was simple:

- Backers must be long-term oriented.

- Backers must add value to both the project (eg via actively supporting the team) and the network (eg via validating or delegating stake).

- Rounds should be structured clearly and transparently so every member has the opportunity to get the same pricing and lockup terms in that round.

- No single player should control an undue amount of stake

Despite the simplicity of these requirements, we were forced to turn away many prospective backers who wanted other incentives. For the record, very few capital allocators are used to being told to write a *smaller* check, but it means that no single backer holds above 3.5% of the initial supply and few have above 1%. Every prior purchaser has a lockup of between 12 and 36 months from transfers unlocking, with the majority at 24 months. Because the first purchase occurred in 2017, some backers will wait over 3 years between their initial purchase and any liquidity and over 5 years to achieve full liquidity.

There’s a difference between the larger, typically more institutional, backers and smaller, typically more independent, backers. A well balanced ecosystem has an appropriate number of both. We capped the total contributions from larger backers while encouraging those from smaller backers. To ensure that small participants could still potentially participate in validation during the network’s early stages, the threshold between the two was set at holding 5M tokens at launch.

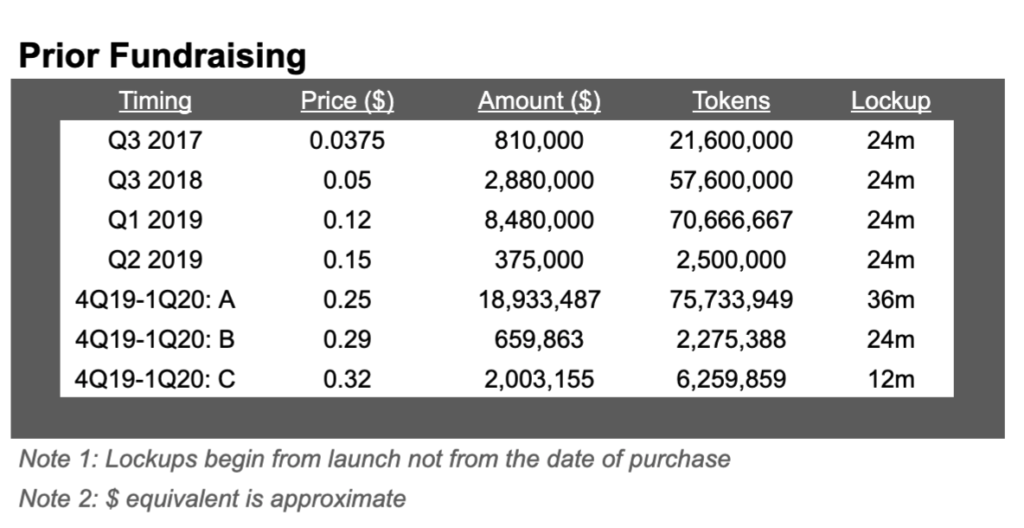

Prior Fundraising

NEAR raised from backers in several tranches which are explained below. Early fundraising was done via convertible notes, of which almost all have since converted to tokens. All are expected to fully convert to tokens.

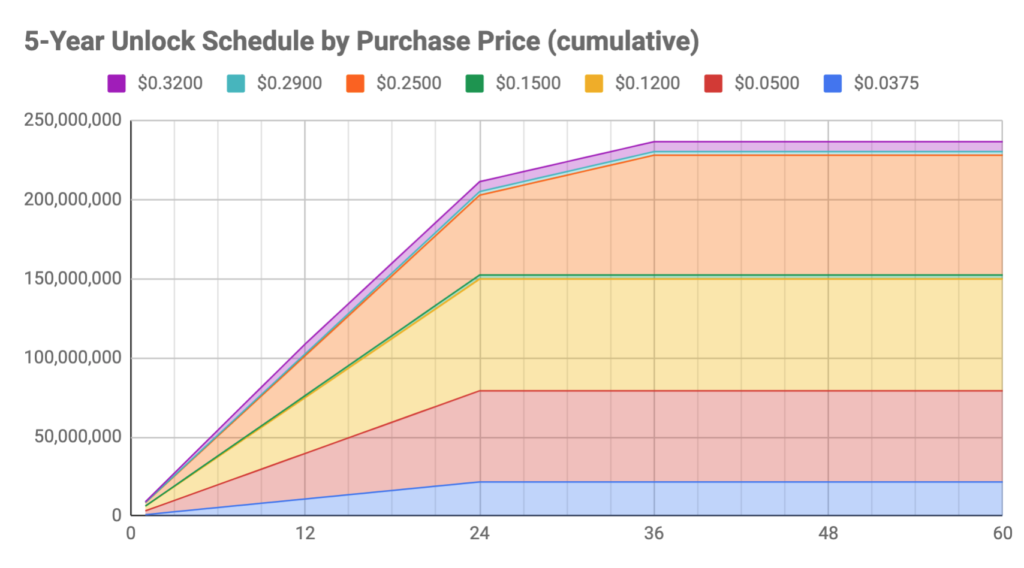

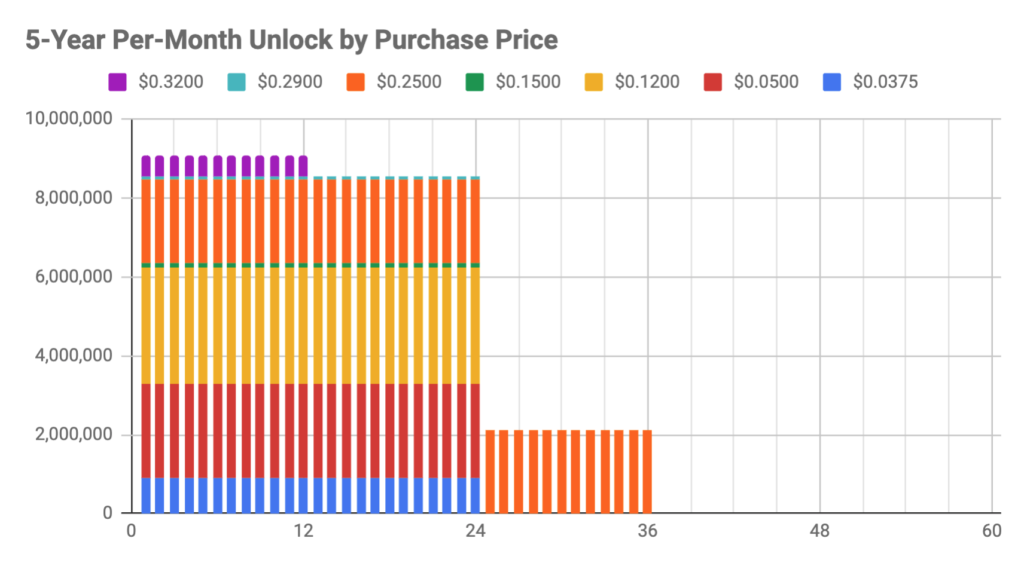

These linear lockups and quantities (which, again, release linearly during their time period) can be visualized in the following ways:

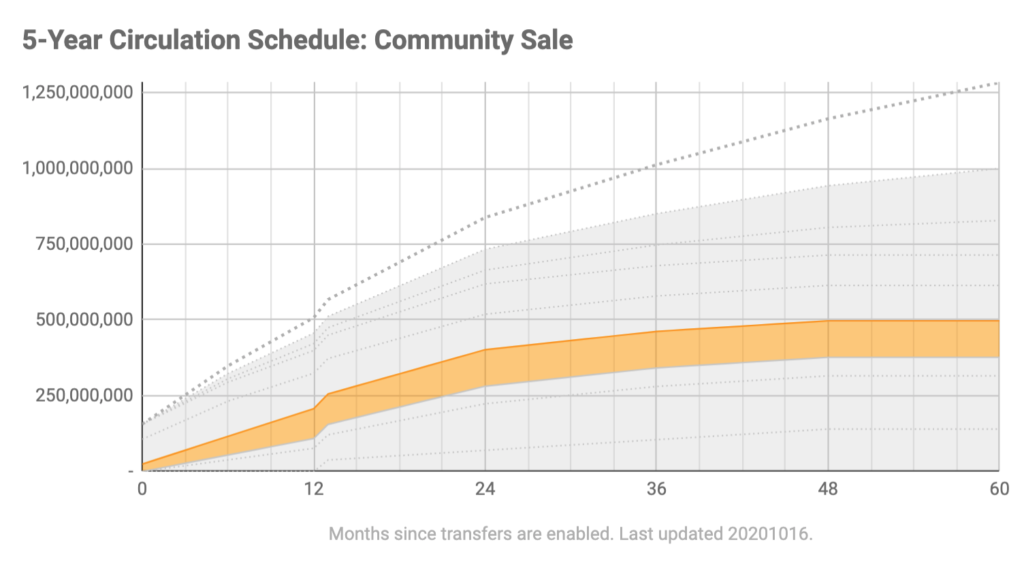

Community Sale

The network at scale will be fully community-driven and that requires making sure the community has the tokens they need. The Community Sale occurred in August 2020 in multiple portions due to some technical difficulties and a desire to improve participation. The total amount that ended up being distributed during the sale period was just over 120M tokens. A maximum of 25M of these tokens were unlocked and the remainder were subject to 12- or 24-month linear lockups.

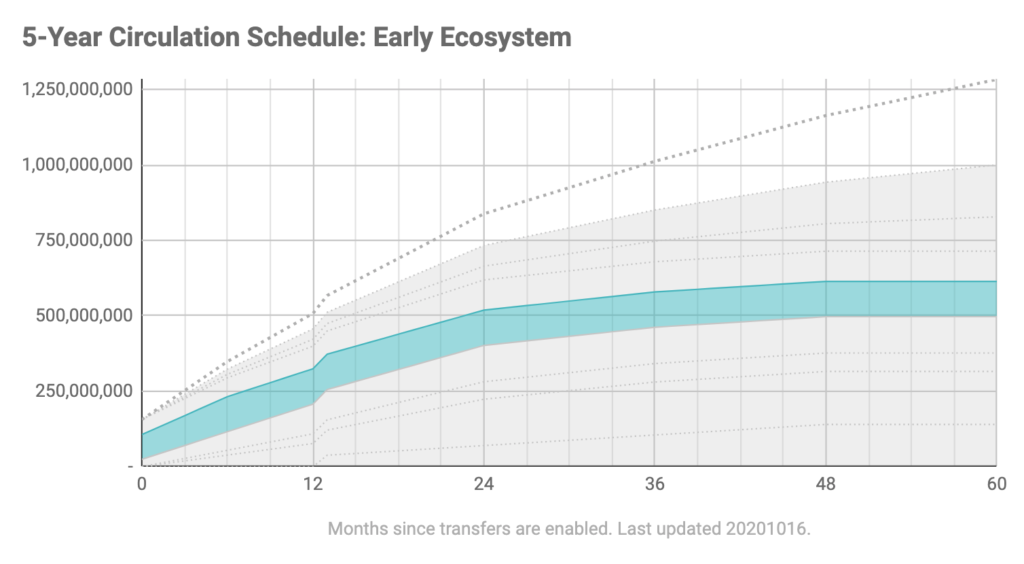

Early Ecosystem

It takes a substantial group of people to put together all the pieces which have made the network successful so far. Early Ecosystem includes all of the grants for those who have participated in the network ecosystem thus far, whether as part of the Beta Program to build early apps, building analytics tooling, supporting the incentivized testnet and so on. Lockups for these efforts are typically 6- or 12-months, though a handful have been shorter or longer. It also includes allocations for several programs that haven’t launched yet.

One of these unannounced programs contains 30M tokens on a 6-month linear lockup. The largest portion in this category is a provision for a currently-unannounced distribution effort which could involve up to 80M unlocked tokens. For details, please wait for the announcement of this program.

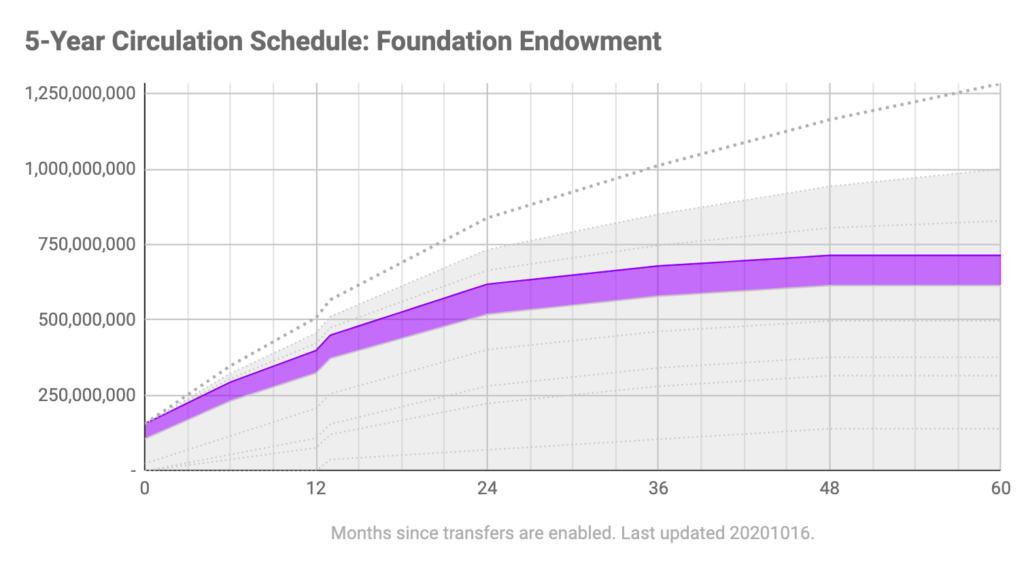

Foundation Endowment

The NEAR Foundation stood up the initial network nodes and spun them down to focus on coordinating the governance of the ecosystem, funding projects and kicking off remaining distribution activities. The Endowment represents a pool of tokens which are meant to support the Foundation’s operations in the long term and which might be deployed in a wide range of ways.

This endowment is split into 2 pieces. The first half, which is not locked up, will likely be deployed across multiple strategies to help ensure the network operates smoothly during its early phases. The second half is subject to a 24 month linear lockup since it is not expected to be accessed during the early days beyond delegation to support decentralization. Both tranches are meant to be deployed in ways which preserve principle wherever possible to ensure long-term availability rather than systematically sold for short-term capital.

As a reminder, the Endowment may not be used to run validating nodes directly but could be delegated, as per the previously linked post.

As part of the initial rollout, the Foundation accounts will be setting up the lockups and accounts for the rest of holders. Some tokens may still be in these accounts during rollout if recipients are delayed in setting up their respective custody solutions.

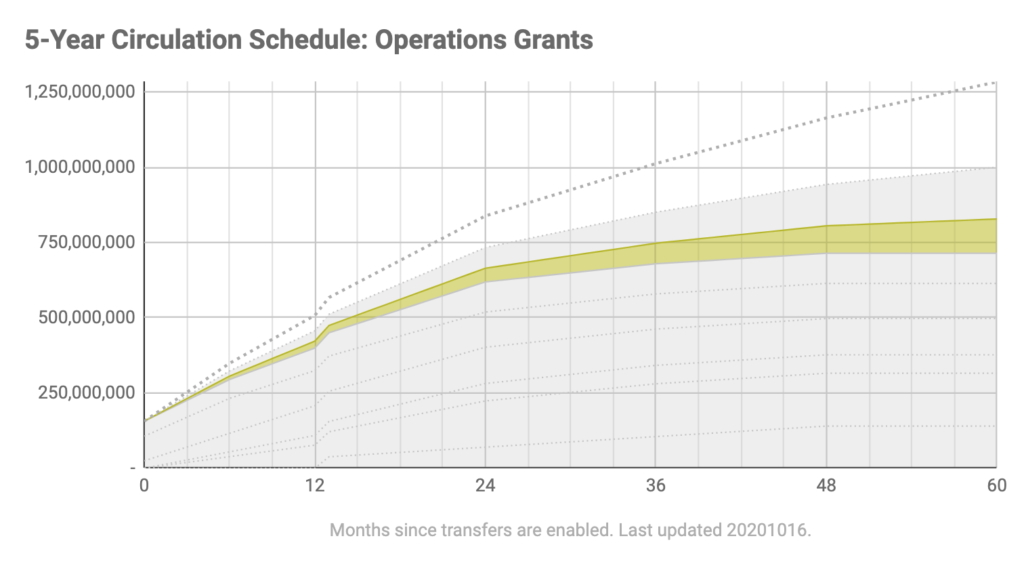

Operations Grants

The technical architecture of the system benefits from the expertise of world-class developers for continuous operation and ongoing development. These efforts will be funded by community-overseen grants that focus on supporting the people who maintain, operate and develop the system itself. These grants are expected to be first initiated during the second half of 2020 and early 2021. The tokens set aside for this purpose are subject to long-term 60-month linear lockups to ensure they are clearly allocated to long-term projects.

New Issuance

New Issuance is not a factor in the genesis block but represents, at its maximum, a 5% growth rate in the supply of tokens. As always, note that this percentage does not factor in the burning of transaction and storage fees since they cannot be easily estimated at this point.

Observed vs Circulating Supply

Now that Phase II has happened and transfers are enabled, the team is working to help create more transparency in the circulating supply. As the first part of this, these are some known variations which will occur between the intended circulating supply (as written in this post) and what might be observable on-chain, particularly during early phases of the network:

- Unclaimed tokens: The biggest variation in circulating supply will be due to unclaimed tokens. These are kept in unlocked accounts until they are claimed (because otherwise they could be claimed), after which almost all of them will have their intended lockups applied. As of the date of Phase II, this number was over 300M tokens.

- Accounting shifts: Similar to the Unclaimed Tokens, during the earliest days, some accounts which are reserved (particularly for Early Ecosystem) are still having lockups applied. There will also be changes in the delegation from the NF during the first few weeks after Phase II while tokens are consolidated into their intended accounts. All of these activities are intended to help make reality reflect the descriptions and charts above. Some buckets may also have short-term vesting provisions to allow for reclamation during the first few days after locking in case of mistakes.

- Account creation tokens: Whenever an account is created (including during the claims process), it receives some initial tokens to cover the storage costs. For complex accounts, that could be as high as 40 tokens. This is not accounted for above but these will appear to be unlocked.

- Inflation lag: There is approximately a 1-week lag between the date when transfers were enabled on the network (Phase II) and when the upgrade will occur to enable inflation on the network. This will result in some of the New Issuance assumptions above being slightly off. This isn’t likely to be significant enough to create major disturbances.

As the analytics tools become stronger after launch and tokens are successfully claimed, you can expect convergence between observed and intended categories.

Conclusion

You can expect additional information over the next several weeks about the project and its activities as the rollout of MainNet continues and distribution begins ramping up. Regardless of your background or intent, there is a way to get involved:

Find your place among the teams that drive this forward at /careers or get involved directly as a Contributor or Guild Leader at /community. If you are a developer, you can jump into the code at https://docs.near.org and if you are already a founder, you can find support for your journey from the Open Web Collective, a platform-agnostic founder community, at https://openwebcollective.com.

Finally, if you are interested in analytics and exploring these numbers (or if you find errors/inconsistencies), please feel free to create tools or views and let us know at [email protected]. Everyone benefits from better transparency and analytics! Some of these tools may also be eligible for grants.

Appendix A: Methodological Notes

- Time buckets should be read as “end of month” unless otherwise noted, meaning the bucket for “month 12” includes the initial balance on the first day of that month plus any change within that month. “Month 0” is the only bucket which is typically used to represent genesis without any additional time.

- The modeling of token releases to represent inflation uses a more simplified average than actual formulas and does not take into account the number of days in a month.

- Amounts are intended to be accurate but may still contain imprecisions and are subject to change.

Appendix B: Change Log

20201016

Many updates. Overall, the expected circulating supply was reduced at genesis and is roughly the same at other major milestones.

- Updated overall circulating supply charts to reflect changes.

- Updated the community sale category to reflect reality and shifts due to the additional sale window. This meant a reduction in other categories, particularly the Team (reduced from ~145M to ~140M) and Early Ecosystem (reduced from ~133M to ~117M, including from the unlocked allocation). Updated Early Ecosystem explanation to reflect reduction in unlocked token bucket from 100M to 80M.

- Minor shifts of ~1-2M each in Operations and Community Grants categories.

- Added a section explaining potential shifts in observed versus planned circulating supply post-phase-II.

- Updated copy and links to reflect latest network status.

- Updated community sale category to reflect actual sale numbers.

- Added note in Foundation about delegation.

20200811

- Fixed legacy mistake in circulating supply in the “Genesis Tokens” section of “About NEAR” to reflect the proper supply.

- Clarified language around the circulating supply

20200810

- Added and separated out a Community Sale category. This has basically the same character as the Small Backers category (where these were located previously) but, in the interest of clarity, it is now separate. It has also been increased to reflect a significantly higher possibility of demand (100M) than originally expected (15M). The increase in token expectation has been shifted from the Community Distribution bucket, which included post-Phase-II sales previously (and are now being optionally allocated to a pre-Phase-II sale to the community). This results in some change in the circulating supply due to shorter lockups in the Community Sale (0, 12 or 24 months) versus the previous Community Distribution bucket (60 months). To reflect the maximum possible allocation of unlocked tokens, initial circulating supply has been increased by 17.5M tokens versus the previous estimate.

- Updated Backers section to reflect this.

- Combined remaining Community Distribution amounts into the Community Grants, Programs and Distribution category and updated category description to reflect this.

- Minor clarifications around the word “Lockup” since this has confused people. In this post, we use “Linear Lockup” or “Linear Release” the way that many other people have used “Vesting” historically. We believe that “Lockup” is still the correct term because, technically, “vesting” items are not yours until they vest whereas locked tokens belong to you from the beginning (they are just locked from being transferred).

- Updated charts and added horizontal axis description “months since transfers are enabled”. Colors have changed.

- Fixed title on the Prior Fundraising table.

- Noted the 30M 6-month program in Early Ecosystem.

- Minor clarity around Phase II in the intro.

20200724:

- Updated to reflect the potential for 100M possibly liquid tokens to be available as part of a currently-unannounced program in the Early Ecosystem category, which readjusted amounts available to the post-launch Community Grants and Community Distribution categories.

- Updated Early Ecosystem balances to reflect that Stake Wars allocations will be unlocked.

- Updated language on Future Fundraises slightly for clarity.

- Updated all remaining charts and tables to reflect changes in circulating supply.

Share this:

Join the community:

Follow NEAR:

More posts from our blog